Reconciliation with the Wealth Tax

Translation by Janet MITRANI

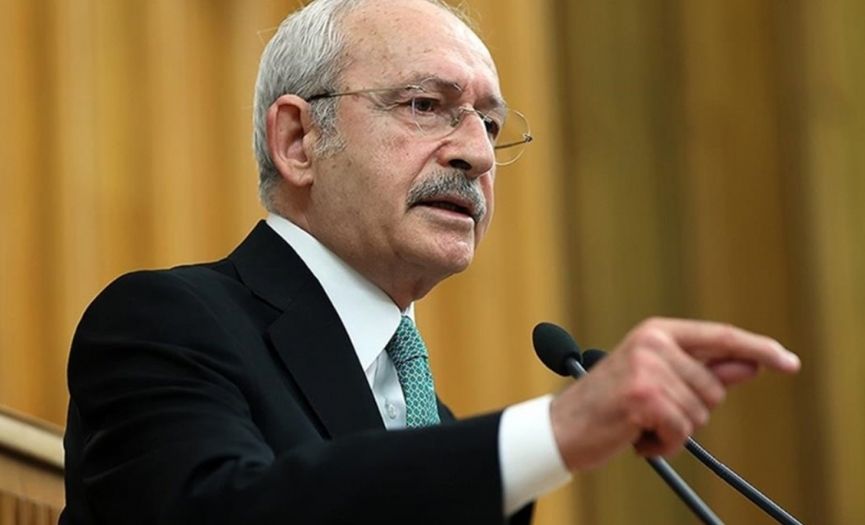

Last week Kemal Kiliçdaroğlu, head of CHP [Republican People's Party of Turkey] would say that they would begin a 'reconciliation' move in order to confront the dismal events that took place in the history of the country, and which had victimized some groups and people, to end the polarization in the country in pursuit of social peace.

Besides, his stating that he would reconcile with the 'minorities who had been weighed down' because of the Wealth Tax legislated by his own party in 1942 and which had turned into a disaster at the end, would be noted in history as a unique act of facing the historical mistakes, not usually seen in the genes of CHP.

Yes, the Wealth Tax had been in effect for exactly 16 months, and in the end the desired goal was achieved. Due to the unjustly implemented tax, the wealth of the Turkish non-Muslims would have changed hands. As during the CHP Parliament meeting closed to the press, Şükrü Saraçoğlu, the Prime Minister of the government implementing the tax, would say:

"This legislation is also a revolutionary law. We are facing a chance to regain our economic independence. We shall thus get rid of the outsiders dominating our market, giving the Turkish market to Turkish people."

What 'outsiders' meant was, the non-Muslim Turkish citizens of course...

♦♦♦

Thomas Piketty, one of the most famous economists of our age, and especially known for his interest in income inequality, in his book titled 'Capital in the Twenty-First Century' written in 2014 and where he has made a reference to Marx, after making very intense global economy and income injustice analyses, made a statement to shake the world when he said, "To save capitalism from the capitalists, a global wealth tax should be implemented." As according to Piketty, while people at the top added to their wealth, their wealth increase was occurring at a much higher rate than the growth of the general economy. He had argued that this case would cause major problems on behalf of social justice and stability, poverty and hunger would gradually come to an uncontrollable stage, and that in the final analysis, a period when capitalism would destroy itself awaited the world. For, of the cake that grew very little, no additional income was reaching the poor.

Piketty's testimony of 7 years ago, can be seen more clearly today. While the economic diminution and shrinkage generated by the pandemic mostly affected the middle class, the capital owners increased their savings even more. Return on capital -simply put, making money from money- has been much more compared to economic return.

Therefore, US President Biden, seeing the gap become wide open, wants to issue a country-wide wealth tax legislation. He's planning on using the $2 trillion additional tax income that will be levied from 700 billionaires, to fund the lower class's education and health needs.

Certainly, wealth tax or property tax has come into the agenda everywhere around the world ever since capitalism entered the world of economy and especially during the war times, it had been implemented to reduce the fiscal deficit.

However, was the 'Varlık Vergisi' levied in 1942, correct? Was it fair?

♦♦♦

November 12, 1942.

While World War II was in full speed and looking for the right way to go after Atatürk's death, the young Turkish Republic finds itself between two hostile powers. England was pressuring us to enter the war on their side, as the Nazis were at the western border and the Russian army was at the eastern border. Ismet Inönü with many successful political maneuvers, makes every effort not to involve his country in war, but the country is in great financial difficulty. He needs extensive resources to prepare his army for war. Inflation in the country is around 70 percent.

The government of the period, like some European countries have resorted to, issues a wealth tax for one time only. The aim is to balance the government budget. The law published in the government gazette, is justified as issued to excise the profiteering trade bourgeoisie. However, this goal was not really observed, and a secondary goal was secretly targeted. Nadir Nadi, one of the leading journalists of the period, while mentioning that the Wealth Tax has two intentions, one official and one private whispered from ear to ear, says, "According to the private reason whispered from ear to ear or even spoken out loud, this law has a second goal such as liberating the market from the domination of the minorities and opening it up to Turkish people."

And thus it would be.

The realities that surfaced later, reveal that the tax is levied rather unjustly against the non-Muslims.

Faik Ökte, the Istanbul Bookkeeper of the period, in his book 'Wealth Tax Disaster' he wrote in 1951, discloses to the public the classifications and ratios that form the basis for the tax's implementation. As Ökte indicates, the taxation classes and ratios have been divided into 5 groups and while for the M (Muslim) group 12.5% of the income to be taxed was levied as tax, for the GM (non-Muslims) this ratio has been 50%. Group D (‘dönme’ - converted to Islam from Judaism centuries ago) has been levied as 25%, group E (foreigners) as 12.5%, and the Farmers as 5%.

According to these numbers, among the two groups who have been claimed to profiteer during the war, namely the non-Muslims and the farmers, the tax difference ratio had been 10-fold.

Upon this injustice, people who couldn't pay either on time or fully, have been sent to the labor camps in Aşkale, and 21 people of approximately 2100 non-Muslims lost their lives in the camps. Ones who could pay their taxes fully, lost nearly all their belongings. The goal had been achieved, in one month the wealth of the non-Muslims had been reduced to zero, their assets had passed to other people.

According to Faik Ökte, beyond losing everything, the non-Muslims would also realize that even though they had been promised equal citizenship at the time of the foundation of the Republic, this was not the case, at all. Ökte, as a conclusion would state that in the Wealth Tax "There is the stigma of chauvinistic nationalism and racism."

Such an unfair implementation of the Wealth Tax, which had been prepared in good faith and had arisen from necessity, would make a big impact abroad, and with the end of the war being clearer in view, the law would be canceled on March 15, 1944, exactly 16 months later it had been implemented, the unpaid tax debts would be forgiven, however no regulations or compensatory adjustments would be made for the taxes paid. The tax would create a story of injustice, both in implementation and cancellation.

According to some historians, the Wealth Tax had dealt a major blow to Turkey's prestige abroad, the country couldn't benefit from the USA's Marshall Plan in the first years and was not accepted into NATO established in 1949. Only after we had sent forces to the Korean War in 1950, we were accepted into NATO.

♦♦♦

Even if Kiliçdaroğlu's reconciliation request is symbolic, it should be a very important step to face the dark pages of history and for social peace.

Every government can make mistakes but to deny the mistake and the 'we don't make mistakes' reflex would only hurt Turkey.

Related News